Manufacturers don’t always pay enough attention to marketing their products. There often seems to be more pressing issues, such as production schedules, quality control, and new product development. Resellers and service organizations don’t have to deal with most of these issues, but, manufacturers do.

With so many complex and important issues, it’s no wonder marketing falls low on the priority list for many manufacturers. As a result, marketing departments can be underdeveloped and underfunded – stifling the business.

So, where does a manufacturer turn to find advice for beefing up marketing?

If you scour the marketing advice available today, you’ll find that expert marketing advice isn’t always pertinent to a manufacturer. For example, many of today’s marketing experts write about gaining subscribers through inbound marketing, and then communicating with them on an ongoing basis with advanced marketing automation software. But, what if you’re a component manufacturer selling to system integrators (as opposed to the end user)? Then you have very few direct customers, and pursuing subscribers is not where I’d put my marketing effort.

After years as a CMO in the manufacturing industry, I came to realize that there are 4 key areas that represent the basics of marketing for manufacturers. These areas must always be in good condition if you’re going to feed your commercial engine. Start with these four:

• Identify your most valuable end markets

• Uncover the needs of your target markets

• Create compelling messaging

• Fund the marketing effort

These are not flashy marketing concepts, they’re fundamental.

Note: This article provides an overview, and I’ve inserted links to other posts where you can find more detail.

1. Identify your most valuable end markets

Your company is designed around your end markets – your departmental structure, the types of people you hire, your geographic footprint, your messaging, your strategic plans – everything. Are you 100% sure that you’re designed around your most valuable end market? Commercial teams always say they can name their best customers. But, what criteria did they use to select their best customers? Annual revenue per customers is the most common answer.

The problem is, the customers that bring in the most revenue are not always your most valuable. Some drain a lot resources – they have a high cost-to-serve.

To market effectively, make sure you concentrate on prospects and customers that truly bring you the most value. In the blog Five Steps to Finding Your Best End Markets I show how to select your highest value customers based on two criteria – Pocket Income and Market Viability.

Pocket income is the bottom line profit after considering cost to serve, and market viability requires identifying whether high pocket income customers reside in a market that has enough prospects to sustain a successful business.

After completing the pocket income analysis, many manufacturers are surprised to discover that their “best” customer actually delivers low gross profit margin percent by draining massive amounts of resources from the organization. Similarly, I have seen manufacturers learn that their tenth largest customer represents their largest end market opportunity.

2. Uncover the needs of your target end markets

Manufacturers realize the importance of knowing customer needs. We can’t interact and deliver in the way the customer wants if we don’t have a comprehensive, unbiased understanding of their needs. Many customers who switch to another supplier state they were satisfied, or even very satisfied, with the original supplier’s performance. Today, so many options are available that just satisfying a customer is not enough to retain them.

To truly know customer needs, it is vital to conduct voice of the customer (VOC) research into your target markets every few years. Make sure your approach will compile a comprehensive, unbiased list of prioritized customer needs. Avoid relying only on legacy information or email customer satisfaction (CSAT) surveys. I recommend a variation of the proven approach by AMS, which is also detailed in our book. Next month, I’ll provide details regarding this approach in a two-part post.

Once you have your current set of customer needs for your target end market, use them to realign your interactions, offerings, and even departmental structure. In addition, don’t forget to use the VOC results to help you train your sales staff. This training approach is touched on in the blog Run an Effective Sales Training Meeting.

3. Create compelling messaging

In manufacturing companies, messaging content can be inconsistent and too focused on specifications. Create your messages around the customer needs first, your offering second. In addition, be consistent. Some research says it takes over seven touches to generate a sales ready lead. Inconsistent messaging reduces the cumulative effect of your interactions. Without consistent, compelling messaging, you will have difficulty building a brand and leads.

When you create messages, you are not creating copy. Messages are themes. When you sit down to write copy for a new marketing activity or piece your messages act as key ingredients for your content. Creating compelling messaging is described in 7 Step Approach to Strong Messaging, and includes an effective method for creating messages that I call the Barbell Message Creation Exercise™.

Messaging follows a hierarchy structure. Atop the hierarchy is the company brand messaging, and it represents the overall company. Then comes messaging for your major products, services, and target end markets. Finally comes messaging for each marketing campaign. The themes cascade downward, with elements of the corporate brand messaging evident at the product level, and so on. Message hierarchy is described in detail here.

Take your messages seriously. Create them carefully, write them down, share them with staff, post them on the walls, make them part of your company culture, and weave them into customer interactions.

4. Fund the marketing effort

Manufacturing companies tend to spend far less of their revenue dollars on marketing than non-manufacturing companies. Some spend less than 2% of total company revenue on marketing operating expenses (excludes staff wages and sales expenses), even though the most successful manufacturers spend 3 to 6% (¹ ’ ²).

Why do some manufacturers under-fund marketing? Sometimes it is because of the leadership’s focus on production issues, but, there is another possible reason. Marketing teams don’t always consistently track and report the ROI of the marketing activities.

Company leaders are used to managing by the numbers. Production and financial reports stream in daily, hourly, or even real-time. Inventory levels, cash flow, and on-time delivery are watched closely. Yet many commercial teams don’t have the same by-the-numbers mentality. The lack of data makes leadership hesitant to provide funding.

A marketing team must be able to justify the marketing budget. The marketing budget must show an ROI, be aligned with the company’s strategic plan, include input from the customer needs analysis, and be targeted to the end markets that provide the company the most value.

I’ll get into creating an effective marketing budget and a persuasive budget presentation in more detail in a future post. In the meantime, consider starting by identifying your current marketing spend buckets (e.g., trade shows, social media, search engine marketing) and the ROI of each major bucket.

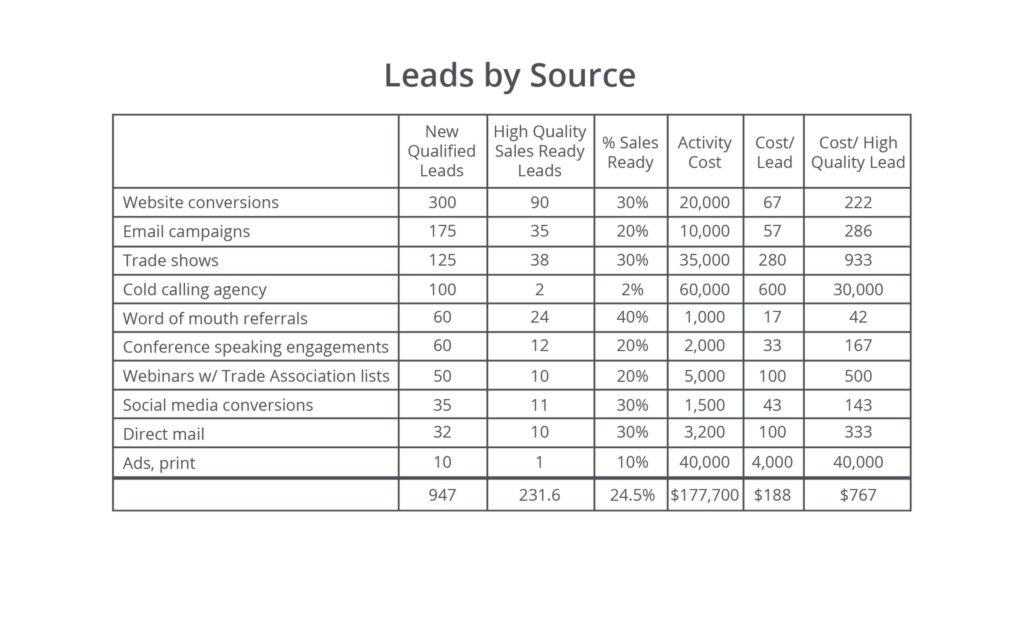

Here is a typical marketing budget allocation (excluding labor) for a mid-sized manufacturer selling high dollar products.

Your spending buckets might be different. The importance of this exercise is to identify your current marketing spending buckets, uncover your cost per lead, and analyze your ROI. The result can be illuminating. Here’s an example.

The average cost per lead in the above table is $188. This number is very important, as it allows you to understand the relative performance of each marketing activity. Of course, some marketing activities such as ads and articles in trade magazines are not intended to generate leads as much as they are advancing your brand. I don’t advocate cutting brand-associated activities – just make sure you allocate a reasonable amount. Building brand gives fuel to the other lead generating activities.

Understanding the ROI of your current marketing spending is key to planning and justifying an appropriate marketing budget. It’s the first step in managing by the numbers. As I mentioned above, I’ll get into more detail regarding rightsizing the marketing budget in a future blog, but hopefully this provides ideas to get you started.

Summary

Not all marketing advice is created equal, and marketing for a manufacturing business is very different than for B2C business or a reseller business. To improve the commercial engine of a manufacturing company, avoid pursuing advanced software and the latest marketing trend until you’ve shored up the fundamentals. Identifying your most valuable end markets, understanding customer needs, developing compelling messaging, and investing adequately in pursuing your target markets are the first fundamental steps.

chip

Latest posts by Chip Burnham (see all)

- Value Pricing Retains Both Customers and Profits - November 14, 2018

- Voice of the Customer – Needs Research - October 17, 2018